dependent care fsa eligible expenses

You may be eligible to claim Dependent Care Flexible Spending Account expenses even if your spouse is not working. You may incur qualified expenses through the end of the Dependent Care FSA Grace Period ending March 15 2023.

Seasonal Expenses To Expect Around The Year Seasons Summer Childcare Expectations

As required by the IRS any funds.

. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Not all expenses can be covered using a dependent care FSA. Ad Custom benefits solutions for your business needs.

Dependent care FSA-eligible expenses include. The IRS determines which expenses. The key is that the account funds are used to cover care-related costs that allow you to work look for work or.

Medical FSA HRA HSA. Before school or after school. The Savings Power of This FSA.

Dependent Care FSA. Easy implementation and comprehensive employee education available 247. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult.

Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2. Children under the age of 13. Qualified dependent care expenses.

A Dependent Care FSA DCFSA is a type of flexible spending account that provides tax-free money for. Dependent care FSA eligible expenses also require documentation. Dependent Care FSA Eligible Expenses.

Dependent Care Expenses Must be for Care Employees dependent care expenses are eligible for reimbursement under the dependent care FSA only if the. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend. Flexible spending accounts FSAs dependent care assistance programs DCAPs health reimbursement arrangements HRAs Commuter and Parking Benefits Tuition Assistance.

Adult day care facilities. Dependent care expenses are paid with tax-free dollars. To be considered qualified dependents must meet the following criteria.

You could save an average of 30 on all of your eligible expenses. In order to claim reimbursement for elder care expenses your dependent elder must live with you for at least eight hours a day and they must be claimed as a dependent on your annual tax. You can use your.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. 16 rows The IRS may request itemized receipts to verify the eligibility of your expenses. Dependent Care Flexible Spending Account FSA.

The IRS has outlined a list of Dependent Care FSA eligible expenses. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses. A spouse who is physically or mentally unable.

If you exclude or deduct dependent care benefits provided by a dependent care benefit plan the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses. A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent. A spouse who is unable to work and care for him or herself.

The care of a spouse or dependent of any age who is physically or mentally. When the expense has both medical and cosmetic purposes eg Retin. Contributions are made pre-tax through payroll deductions.

Summer camps for dependent. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including. The cost of routine skin care face creams etc does not qualify.

The money in your FSA can only be used for expenses for. Daycare preschool senior care and more can be eligible. A dependent who is younger than 13.

The Dependent Care FSA does for childcare expenses what the Healthcare FSA does for healthcare expenses. Whose expenses can I claim under my FSA. Elevate your health benefits.

An itemized receipt with the five pieces of. Three IRS rules determine who does and does not qualify. Get a free demo.

What qualifies as an dependent care FSA eligible expense.

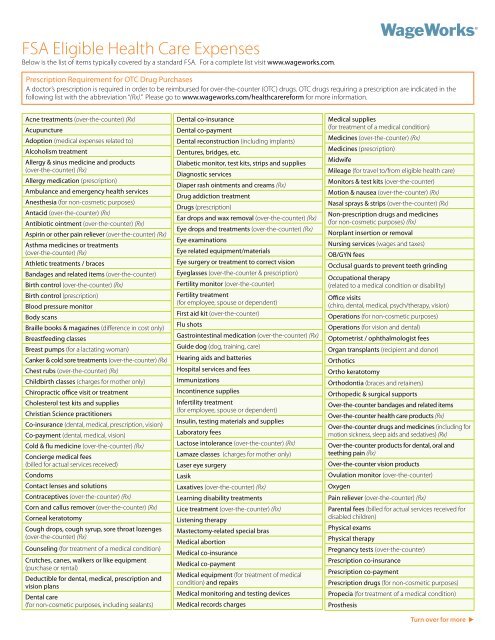

Healthcare Fsa Eligible Expenses Table Wageworks Healthcare Fsa Health Care Expensive

How To File A Dependent Care Fsa Claim 24hourflex

Dependent Care Fsa University Of Colorado

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Health Care Flexible Spending Account Otosection

Why You Should Consider A Dependent Care Fsa

Tax Saving Opportunity For Employees Accounting Services Tax Opportunity

Fsa Open Enrollment 24hourflex

What To Know About Dependent Care Fsas And Saving Money On Childcare Real Simple

Navia Benefits Health Care Fsa

What Is A Dependent Care Fsa Tl Dr Accounting

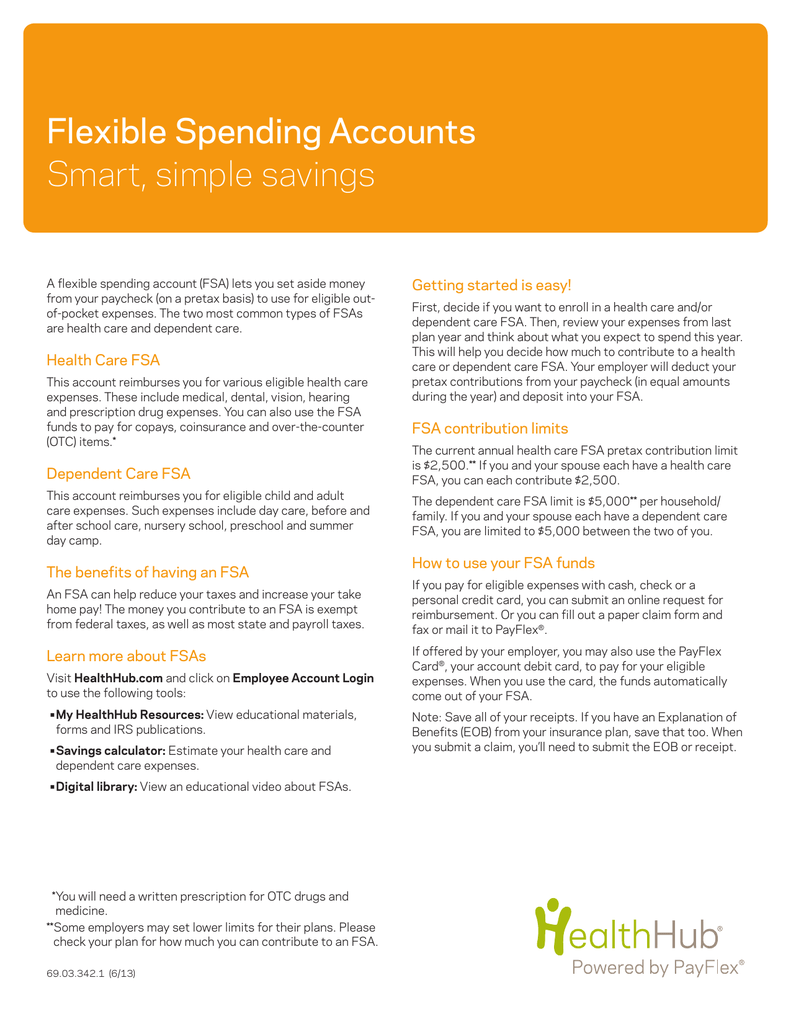

Flexible Spending Accounts Smart Simple Savings Getting Started Is Easy

There Are Many Benefits Of Having A Flexible Spending Account Taxes Fsa Flexiblebenefits Health Flexibility Accounting Benefit

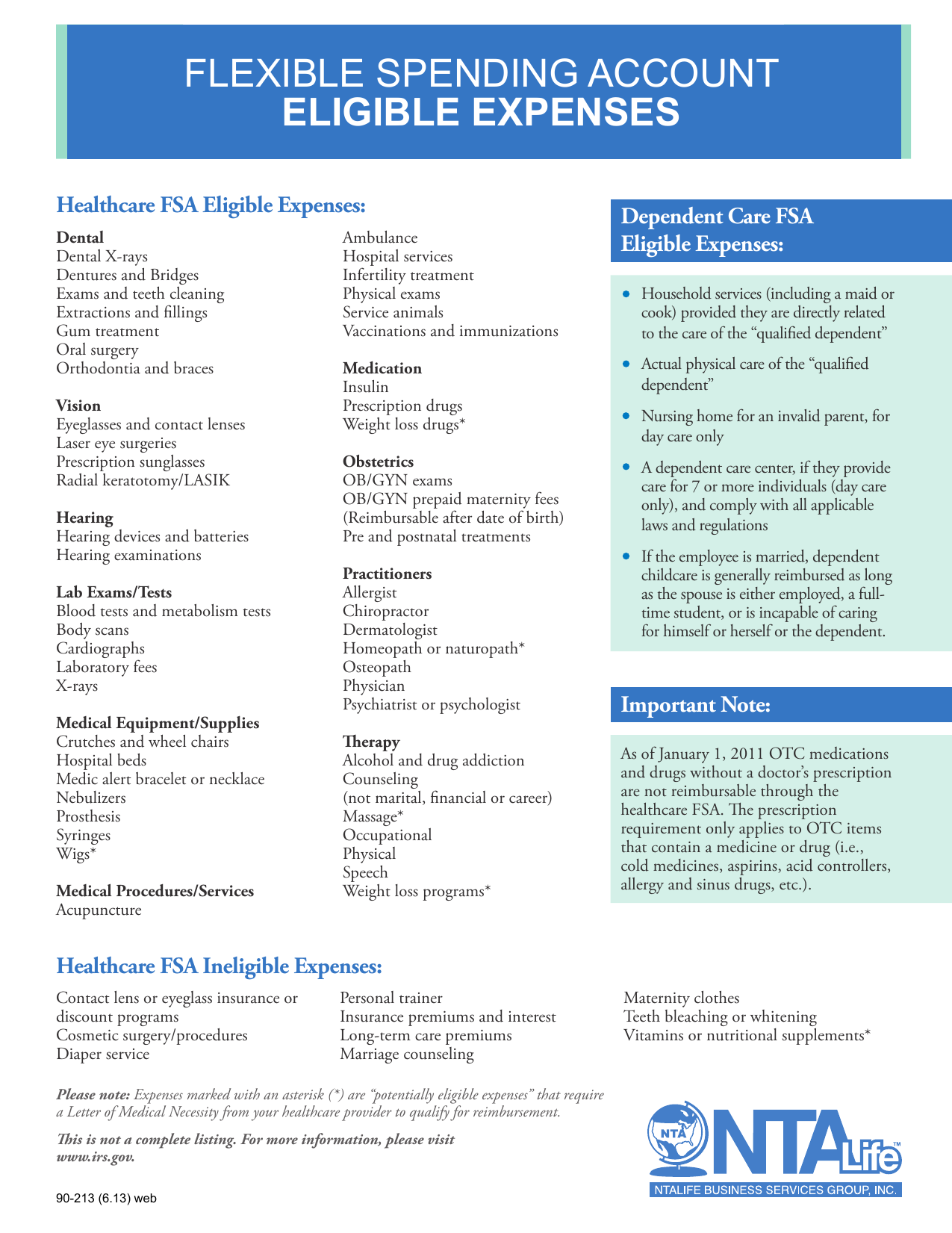

Flexible Spending Account Eligible Expenses

Fsa Eligible Health Care Expenses

Erika Seaborn M A On Instagram Hsa Vs Fsa Smart Money Health Plan Hsa